Risk and Reward

THE VALUE OF INVESTMENTS AND THE INCOME THEY PRODUCE CAN FALL AS WELL AS RISE. YOU MAY GET BACK LESS THAN YOU INVESTED.

TAX TREATMENT VARIES ACCORDING TO INDIVIDUAL CIRCUMSTANCES AND IS SUBJECT TO CHANGE.

You should understand the degree of risk you are willing to accept before undertaking any kind of investment. People have very different attitudes to risk and you need to be clear about the degree of risk you are willing to accept.

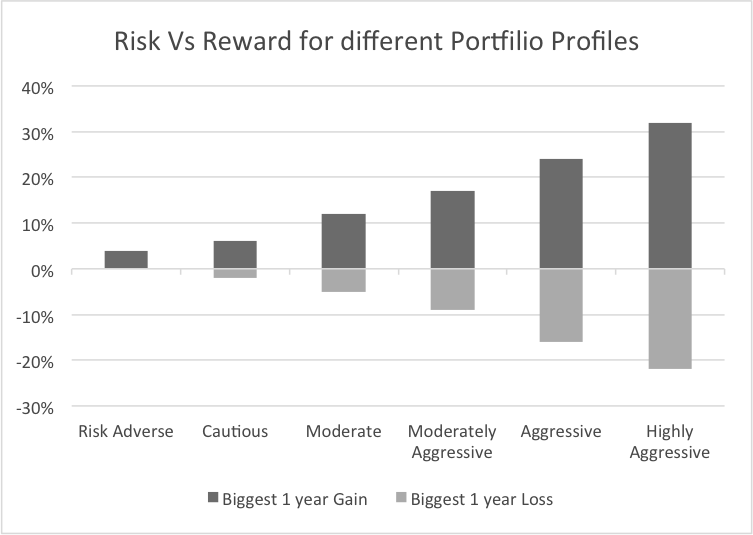

The following is an example of a Risk/Reward profile. These risk categories are for guidance only.

The following is an example of a Risk/Reward profile. These risk categories are for guidance only.

The risk of an investment is affected by a number of factors and varies depending on the timeframe of an investment. A volatile investment such as a share in a company may be very risky over a short timeframe but less risky than being in cash over a long period.

There is a balance between risk and potential return and, in general, higher risk investments usually mean that higher returns are possible but the risk of losing money is also increased. Lower risk generally means lower returns but a lower risk of losing money.

The risk of an investment varies according to how long the investment is held. With volatile investments such as property and shares you should be looking to invest for a minimum of ten years.

Risk can also be varied by how you invest. Combining different types of investment (property, shares, bonds and cash) via an asset allocation model can help to even out these swings in value, especially if they are "non-correlated" (i.e. their prices move independently). This is why it usually makes sense even for investors to have some exposure to bonds and cash even though their long term potential is less than that of property and shares.

Our job as advisers is to help you understand enough of this to make wise decisions for your savings and minimise the time you need to spend on your investments - we want to take this hassle away from you, If you have chosen to have ongoing reviews of your funds then we will ensure that they remain within your current risk rating and remain suitable for your objectives.

Free Consultation

You can have a free initial consultation. There's no fee, no catch and no obligation on your part.

Next.